Budget 2021 Malaysia Personal Tax Relief, Malaysia Budget 2021 Highlights Mypf My

RM8000 including vaccination expenses and full medical check-up up to RM1000 each In Budget 2021 the scope of the tax relief was expanded to include expenses on certain vaccinations including COVID-19 for self spouse and child. Per child below 18 years old 2000.

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done The Edge Markets

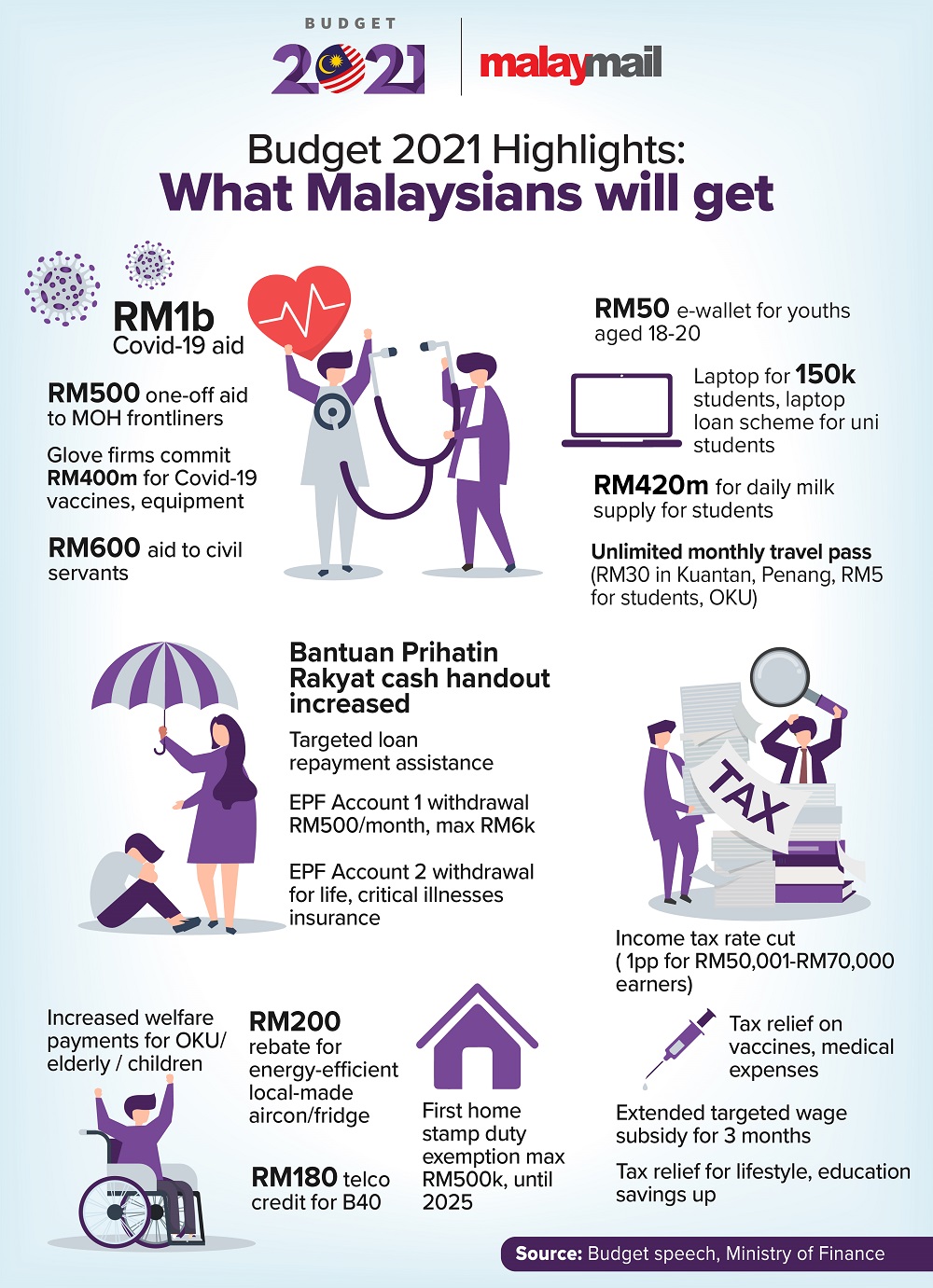

For the tourism and retail sector there will be a target wage subsidy programme that will be.

Budget 2021 malaysia personal tax relief. The threshold for approved cash donations has been standardised at 10 currently 7 for persons other than companies of aggregate income. In Budget 2021 it was proposed that the individual income tax relief for complete medical examination expenses be increased from RM500 to RM1000 effective from the year of assessment 2021 legislated via the Finance Act 2020 that has come into operation on 1 January 2021. This website uses cookies.

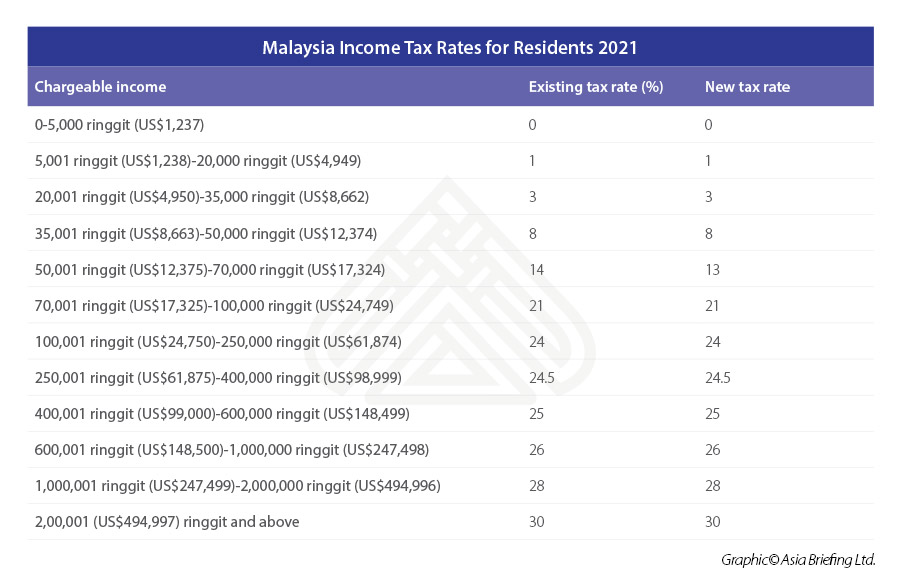

5000 Limited 3. To increase the disposable income of individuals from the middle-income group who may have been affected by the current economic situation the 2021 budget proposes that the tax rate for this chargeable income band be reduced by one percentage point. Medical expenses for serious diseases for self spouse and child.

Posted on September 29 2020 by. 4 2021 Malaysia Budget Highlights Goal 1. 2 This income tax relief can be shared with other siblings provided that the total tax relief claimed does not exceed MYR 1500 for a mother and MYR 1500 for a father.

The PRS Tax Relief has proven to be effective in encouraging Malaysians to save more for. Reliefs are available to an individual who is a tax resident in Malaysia in that particular YA to reduce the chargeable income and tax liability. Personal Tax Reliefs in Malaysia.

Income tax rate for resident individuals to be reduced from 14 to 13 for the chargeable income band of RM50001 to RM70000 from Year of Assessment YA 2021. Personal income tax relief 2021 malaysia. KUALA LUMPUR Nov 6 The government announced reduced rates for income tax as part of Budget 2021 tabled in Parliament today by Finance Minister Datuk Seri Tengku Zafrul Abdul Aziz.

The current tax year is from 6 April 2020 to 5 April 2021. Companies are not entitled to reliefs and rebates. Per child over 18 years old.

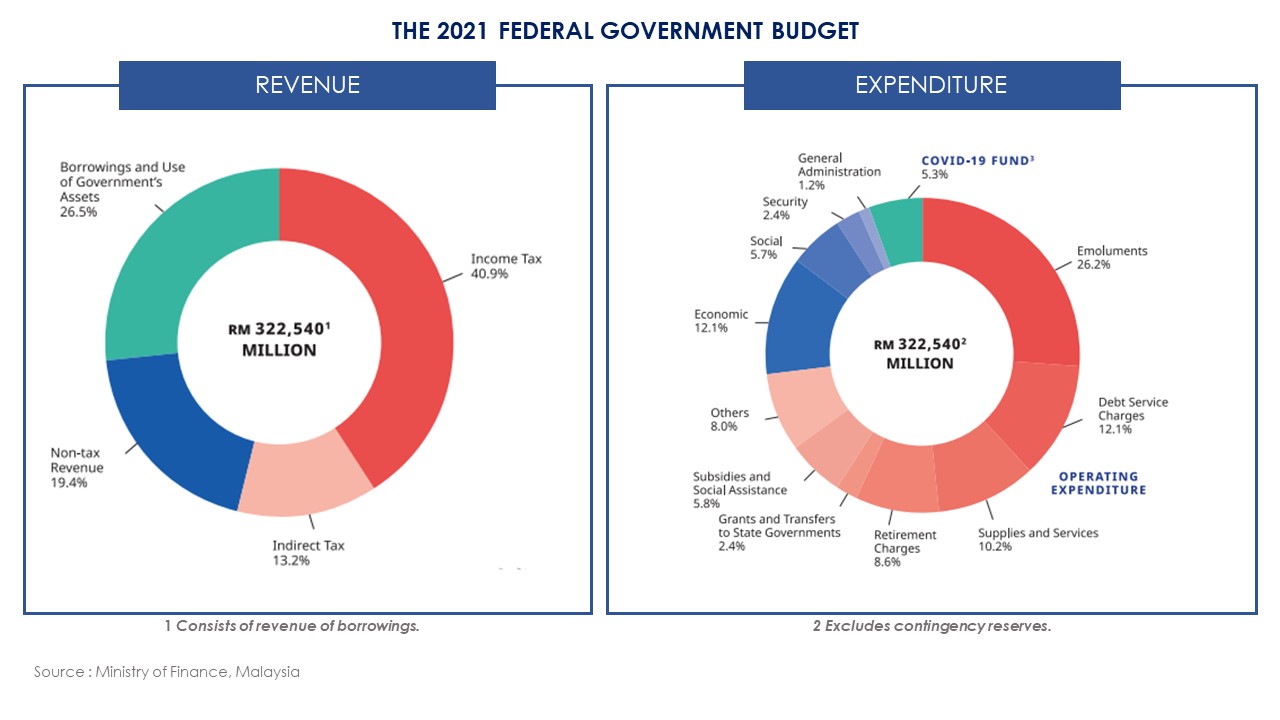

Budget 2021 is the largest budget in Malaysias history with a total of RM3225 billion compared to RM297 billion for Budget 2020. Non-resident individuals tax rate remains at a flat rate of 30 Effective from year of assessment YA 2021. The government has allocated RM70 million to address mental health issues exacerbated by the Covid-19 pandemic.

The Rakyats Well Being Contd For YA 2020 and 2021 the income tax exemption limit for compensation for loss of employment will be increased from RM10000 to RM20000 for every full year of service. Income tax reduction for RM50001 to RM70000 band Resident individuals who are within the chargeable income band of RM50001 to RM70000 will enjoy a 1 income tax reduction. Published by on May 29 2021 on May 29 2021.

The tax highlights of Budget 2021 include. The income tax rates 2021 exemption limit for compensation for loss of employment will be increased from RM10000 to RM20000 for each full year of service. Review of Income Tax Rate Limited to 5 non- Malaysian citizens employed in key positions C -suites positions with monthly salary of not less than RM25.

BUDGET 2021 The government has announced a slew of tax relief incentives under Budget 2021 including reducing the personal income tax. Income Tax Reliefs For Psychotherapy Counselling By CodeBlue Posted on 29 October 2021 29 October 2021. Amount RM 1.

The conditions of entitlement for each relief must be satisfied in order to minimize the income tax liability. To encourage saving for retirement the RM3000 tax relief on Private Retirement Scheme PRS contributions has been extended until YA 2025 said. Extension of personal tax reliefs.

Reliefs YA 2021 MYR. The main objective is to help taxpayers who have lost their jobs due to the current pandemic. The government has agreed to lower the rate for individual income tax by one percentage point for those earning taxable wages from RM50001 to RM70000 which.

Malaysia presented the 2021 Budget proposals announcing a slight reduction in the individual income tax rate by 1 percent for resident individuals at the chargeable income band of MYR 50001 to MYR 70000. Receiving full-time instruction of higher education in respect of. The scope of the medical check-up relief of RM1000 is expanded to include COVID-19 screening tests.

There is also an increase an extension and an expansion of the scope of tax reliefs. TaXavvy Budget 2021 Edition - Part 1 8 Personal Tax Reduction of individual income tax rate It is proposed that the resident individual tax rate be reduced by 1 from 14 to 13 for the chargeable income band RM50001 to RM70000. YA 2021 RM Self.

Disabled spouse - additional spouse relief Note 5 5000. The Government announced that the scope of complete medical examination. Natálie Šteyerová Pixabay.

Reduction in personal income tax rate by one percentage point for tax resident individuals for chargeable income in the band of RM50001 to RM70000 Preferential 15 personal tax rate for non-Malaysian citizens holding key positions in companies that relocate their operations to Malaysia under the PENJANA incentive package. KUALA LUMPUR Oct 29 Finance Minister Tengku Zafrul Aziz today announced. Budget 2021 malaysia tax relief.

Full tax exemption for electric vehicles RM2500 personal tax relief for EV charging facilities October 29 2021 Still experiencing network problems with Digi. When the first few Covid-19 cases cropped up in Malaysia all insurance and takaful operators. - diploma level and above in Malaysia.

From expanded medical tax reliefs to an anticipated income tax reduction here are the personal income tax highlights from Budget 2021. Disabled individual - additional relief for self. Income tax rate for.

4 December 2020. Below 18 years of age. Spouse under joint assessment 4000.

Over 18 years of age who is receiving full-time instruction at an establishment of higher education in Malaysia at diploma level and higher or outside Malaysia at degree level and above or serving under article of indentures in a trade or profession provided certain.

Budget 2021 Vital To Boost Investment Sentiment The Star

Budget 2021 Highlights Here S What Malaysians Can Expect To Get Directly Tax Breaks Handouts Subsidies And More Malaysia Malay Mail

Budget 2021 Here Are The Key Highlights And Takeaways For You

Malaysia Personal Income Tax 2021 Major Changes Youtube

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2021 Homage Malaysia

List Of Lhdn S Income Tax Relief For E Filing 2021 Ya 2020

Budget 2021 Here Are The Key Highlights And Takeaways For You

Malaysia Budget 2021 Commentary 27 Advisory

Malaysia Budget 2021 Highlights Mypf My

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

Highlights Of Budget 2021 Cheng Co

Malaysia Personal Income Tax Relief 2021

Malaysia Budget 2021 Highlights Mypf My

Everything You Should Claim For Income Tax Relief Malaysia 2021 Ya 2020

Malaysia Budget 2021 Personal Income Tax Goodies

Key Takeaways Of Malaysia Budget 2021

Individual Income Tax Amendments In Malaysia For 2021

Malaysia Budget 2021 Highlights Mypf My

Post a Comment

Post a Comment